In today’s fast-paced world, managing your finances effectively is more important than ever. Whether you’re looking to save for a significant life event, pay off debt, or simply gain better control over your spending, adopting the right budgeting strategies can make all the difference. Here, we explore some of the most effective budgeting techniques that can help you take charge of your financial future.

1. Zero-Based Budgeting: Every Dollar Has a Job

Zero-based budgeting is a method where your income minus your expenses equals zero. This means every dollar you earn is assigned a specific purpose, whether it’s for bills, savings, or investments. By giving every dollar a job, you ensure that no money is left unaccounted for, reducing the risk of unnecessary spending.

Steps to Implement Zero-Based Budgeting:

- List your total monthly income.

- Track and categorize all your expenses.

- Allocate funds to each category until your income minus expenses equals zero.

- Adjust allocations as necessary throughout the month to stay on track.

2. The 50/30/20 Rule: A Balanced Approach

The 50/30/20 rule is a straightforward budgeting strategy that divides your after-tax income into three categories:

- 50% for needs: Essentials such as housing, utilities, groceries, and transportation.

- 30% for wants: Non-essential expenses like dining out, entertainment, and hobbies.

- 20% for savings and debt repayment: Savings accounts, retirement funds, and paying off debt.

This method helps maintain a balanced budget that covers your necessities while allowing room for enjoyment and future financial security.

3. The Envelope System: Tangible Money Management

The envelope system is a cash-based budgeting technique that involves dividing your income into different spending categories and placing the allocated cash into physical envelopes. Once the cash in an envelope is spent, you can’t spend more in that category until the next budgeting period.

How to Use the Envelope System:

- Determine your spending categories (e.g., groceries, entertainment, gas).

- Allocate cash to each category based on your budget.

- Use only the cash from the corresponding envelope for expenses in that category.

- When an envelope is empty, you stop spending in that category until you refill it.

4. Budgeting with Irregular Income: Flexibility is Key

For freelancers, contractors, and others with fluctuating income, budgeting can be challenging. However, with careful planning, you can still manage your finances effectively.

Strategies for Irregular Income:

- Base your budget on the lowest monthly income: Use your lowest expected income as the basis for your essential expenses.

- Prioritize expenses: List your expenses from most to least important and fund them in that order.

- Create a buffer: Build a savings buffer to cover months when income is lower than expected.

- Adjust regularly: Review and adjust your budget frequently to reflect your current income situation.

5. Digital Tools: Modern Solutions for Budgeting

In the digital age, numerous apps and tools can simplify budgeting and help you stay on track. These tools offer features like expense tracking, bill reminders, and financial goal setting, making it easier to manage your money.

Popular Budgeting Apps:

- Mint: Tracks expenses, sets budgets, and provides a complete financial picture.

- YNAB (You Need A Budget): Focuses on zero-based budgeting and offers detailed financial insights.

- PocketGuard: Helps control spending and tracks bills and subscriptions.

- EveryDollar: A simple, user-friendly app based on zero-based budgeting.

6. Setting Realistic Financial Goals: Plan for Success

Setting and achieving financial goals is a crucial part of budgeting. Clear goals give you direction and motivation, making it easier to stick to your budget.

Tips for Setting Financial Goals:

- Be specific: Define clear, precise goals (e.g., save $5,000 for an emergency fund in 12 months).

- Make them measurable: Track your progress with specific milestones.

- Ensure they are attainable: Set realistic goals that are challenging yet achievable.

- Stay relevant: Align your goals with your long-term financial objectives.

- Set a timeline: Establish deadlines to maintain focus and urgency.

7. Tracking Your Spending: Awareness is Power

Keeping a close eye on your spending habits is essential for effective budgeting. By tracking your expenses, you can identify patterns and areas where you can cut back.

Methods for Tracking Spending:

- Use a spreadsheet: Manually input your expenses and categorize them.

- Leverage apps: Utilize budgeting apps that automatically track and categorize spending.

- Review bank statements: Regularly review your bank and credit card statements.

- Keep receipts: Save receipts and log them in a tracking system.

Mastering budgeting is a critical step towards achieving financial freedom. By adopting these budgeting strategies, you can gain better control over your finances, reduce unnecessary spending, and work towards your financial goals with confidence. Remember, the key to successful budgeting is consistency and adaptability—regularly review and adjust your budget to ensure it meets your evolving needs and circumstances.

Start implementing these strategies today, and take the first step on your journey to financial independence!

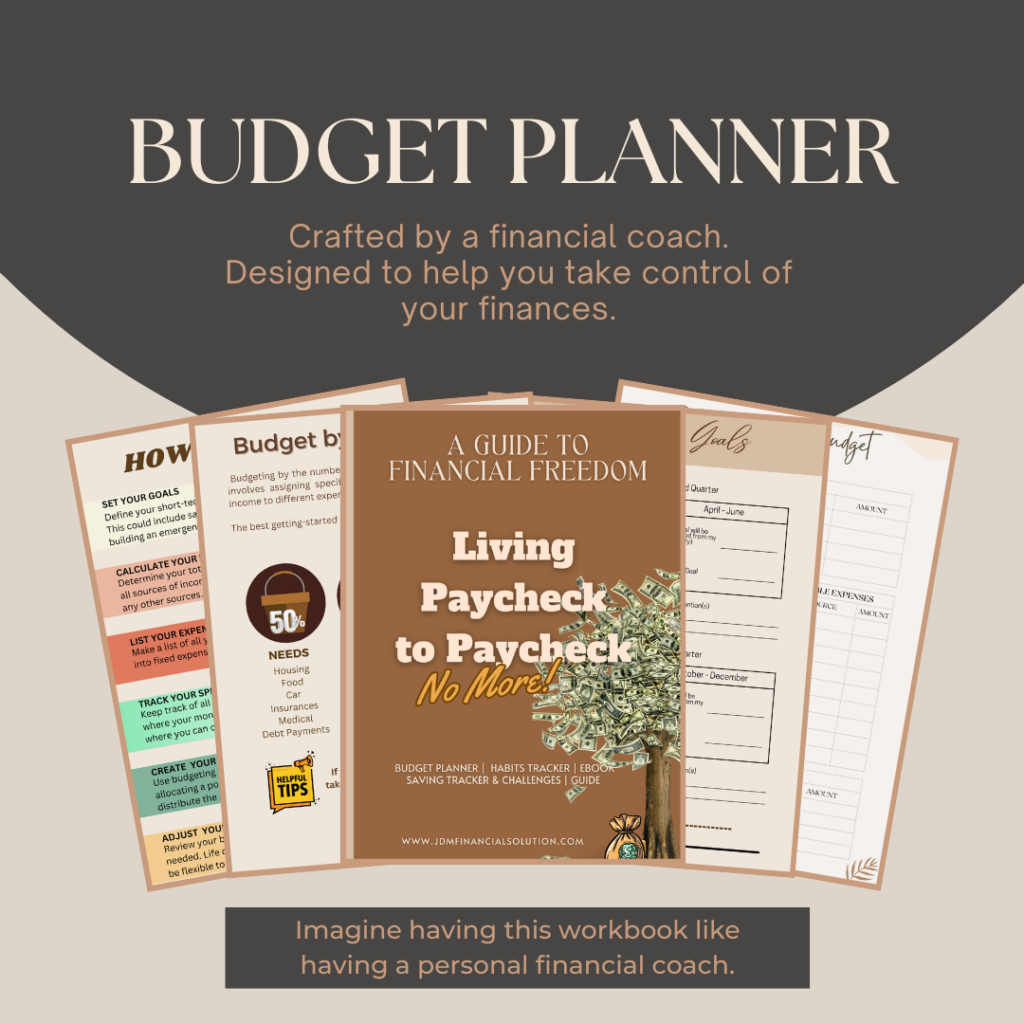

To grab these financial freedom tools visit https://jdmfinancialsolution.com/ .